Perrigo settles €1.64bn tax bill for €297m with support from A&L Goodbody

Pharmaceutical company Perrigo has settled a €1.64 billion tax bill – the largest assessment ever issued by the Revenue Commissioners – for €297 million.

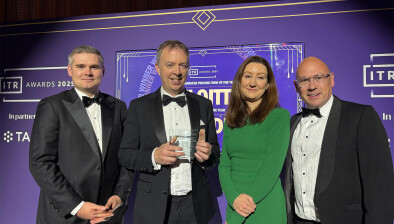

A&L Goodbody represented Perrigo in its appeal before the Tax Appeals Commission, but the matter has now been settled in advance of the hearing.

The assessment concerned the tax treatment of the proceeds of sale by Elan in 2013 of intellectual property rights to a pharmaceutical product for the treatment of multiple sclerosis called Tysabri. Perrigo acquired Elan soon after the 2013 transaction and took on the tax consequences of the transaction.

The High Court first examined the issuance of the amended assessment and ruled last year that Revenue had the right to issue the amended assessment, but left over to the Tax Appeals Commission the question of whether Perrigo or Revenue was correct on the tax treatment of the proceeds of the 2013 transaction.

Perrigo treated the transaction in its corporation tax returns as part of its trade. The Revenue believed it should properly have been treated as a capital transaction, attracting tax at an effective rate of 33 per cent rather than 12.5 per cent.

The fact that the matter has been settled in advance of the hearing before the Tax Appeals Commission means that there will be no formal determination of the disputed issue on whether the 2013 disposal was a trading transaction or a capital transaction.